Project Description

The Eagle and Olive deposits are situated within Victoria Gold’s Dublin Gulch property. The Eagle deposit is actively being mined using open pit methods. Based on current reserves, the Eagle deposit will provide 110.4 million tonnes of ore while the Olive deposit will provide 6.5M t for a total of 116.9M t from January 2020 until completion of operations in 2030. An additional 32.1M t of low-grade ROM ore will also be mined over this period, resulting in a total extraction of 149.0M t. Waste mining will total 144.9M t for an overall strip ratio of 0.97:1. Production rate will be an average of 13.0 million tonnes per annum (M t/a) comprised of 29,500 t/d ore and 7,500 t/d ROM over a thirteen-year mine life, excluding the ramp-up period.

Gold is extracted from ore into a solution by a heap leaching process using two heap leaching pads (HLPs) – a primary and a secondary. Heap leach feed consists of crushed ore (116.9M t at 0.78 g/t Au) conveyed to the HLPs as well as run-of-mine (ROM), un-crushed (32.1M t at 0.22 g/t Au) ore, which is hauled directly to the HLP for leaching. The current plan is to stack both crushed and ROM ore on the primary HLP and secondary HLP.

Crushed ore is being fed through a three-stage crushing plant to produce an 80% passing (P80) 6.5 mm product. All ROM ore will bypass the crushing plant.

Gold is being leached with cyanide solution and recovered by an adsorption-desorption-recovery (ADR) carbon plant.

A total of 2,406k oz of gold will be recovered over a thirteen-year mine life from 77% overall recovery.

Property Description and Ownership

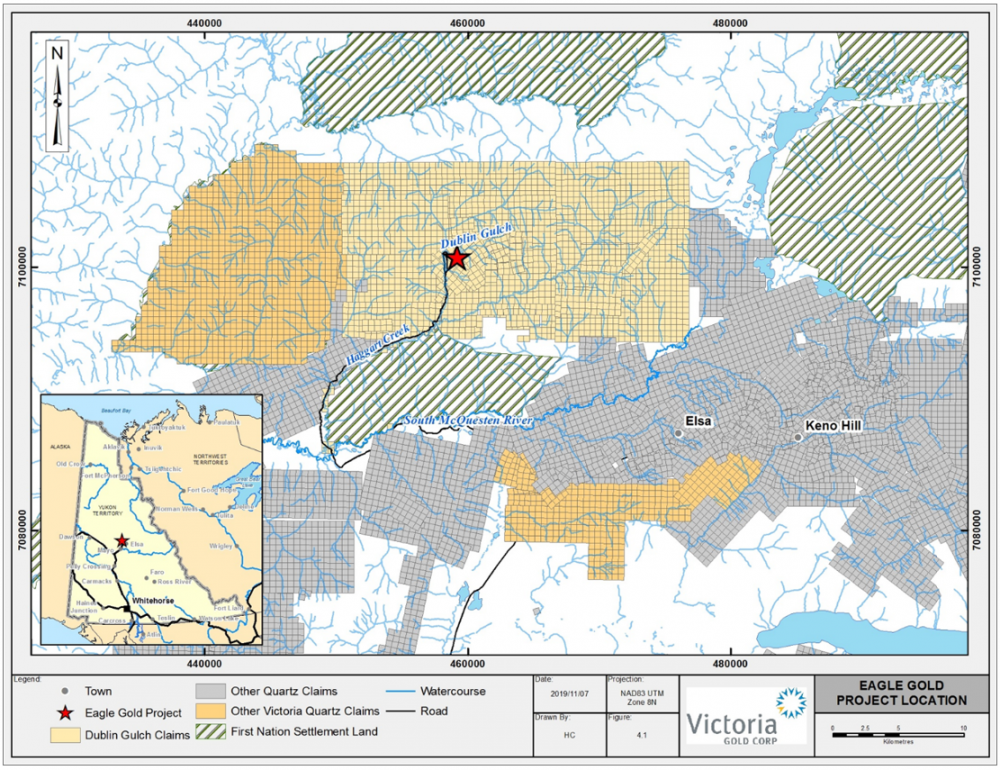

The Eagle Gold Mine is situated approximately 350 km north of the Yukon capital of Whitehorse. Access to the project from Mayo is via the Silver Trail (Highway 11), then onto the South McQuesten and Haggart Creek Roads that terminate at the mine site.

The Mine is situated within the Dublin Gulch property, which is a contiguous block of 1,914 quartz claims, 10 quartz leases, and one federal crown grant all of which are under the control of Victoria Gold’s wholly owned, directly held subsidiary Victoria Gold (Yukon) Corp. The Dublin Gulch property is rectangular in shape and extends approximately 26 km in an east-west direction and 13 km in a north-south direction covering an aggregate area of approximately 35,000 hectares (ha).

Figure 1: Property Location Map

Geology & Mineralization

The Dublin Gulch property (Eagle Gold Mine) is underlain by upper Proterozoic to lower Paleozoic clastic sedimentary rocks that have undergone regional deformation including Cretaceous age thrust faulting and subsequent granitoid intrusions. Mineralization is associated with granitic intrusive bodies, here described as the Eagle Zone and Olive Zone gold deposits, which are hosted primarily in granodioritic rocks. The gold deposits occur within the Tombstone Gold Belt, located in the eastern portion of the Tintina Gold Province, which also hosts the Brewery Creek deposit and other gold occurrences in the Yukon.

The property is located on the northern limb of the McQuesten Antiform and is underlain by Proterozoic to Lower Cambrian-age Hyland Group metasediments and the Dublin Gulch intrusion, a granodioritic stock. The Dublin Gulch Stock is comprised of four intrusive rock phases, the most significant of which is Granodiorite. The stock has been dated at approximately 93 Mega annum (Ma).

The metasediments are the product of greenschist-grade regional metamorphism. Proximal to the Dublin Gulch Stock, these metasediments have undergone metasomatism and contact metamorphism. A hornfelsic thermal halo surrounds the stock and within the halo, the metasediments have been altered to schist, marble and skarn

The Eagle and Olive zones belong to the RIRGS class (Reduced Intrusion-Related Gold Systems) of mineral deposits.

The Eagle Zone gold occurrence is localized at the narrowest exposed portion of the stock. The Eagle Zone mineralization is comprised of sub-parallel extensional quartz veins that are best developed within the granodiorite.

Sulphides account for less than 5% of vein material and occur in the centre, on the margin, and disseminated throughout the veins. The most common sulphide minerals are pyrrhotite, pyrite, arsenopyrite, chalcopyrite, sphalerite, bismuthinite, molybdenite and galena. Secondary potassium feldspar is the dominant mineral in alteration envelopes. Sericite-carbonate is generally restricted to narrow vein selvedges, although alteration zones of this type also occur with no obvious relation to veins. Gold mineralization also occurs within the metasedimentary rock package immediately adjacent to the granodiorite.

The Eagle Zone is the principal concentration of mineralization within the property. The Eagle Zone is irregular in plan and is approximately 1,600 m long (east-west) and 600 m wide north-south. The Eagle Zone is near-vertical and has been traced for about 500 m below surface. Current drilling indicates that the mineralization is relatively continuous along this length and is open in several directions, including at depth. Mineralization occurs as elemental gold, both as isolated grains and most commonly in association with arsenopyrite, and less commonly with pyrite and chalcopyrite. The sulphide content in the veins is typically less than 5%, and is less than 0.5% within the deposit overall, with 1 to 4% carbonate (calcite) present.

The Olive Zone gold occurrence is localized at the contact zone on the northwest flank of the granodiorite intrusive and located 2.5 km northeast of the Eagle Zone. Olive measures approximately 20 to 80 m in width, 900 m in length, and has been drilled to approximately 175 to 250 m in depth. Over 97% of the gold mineralization in the Olive Zone is hosted in granodiorite.

Compared to Eagle, the Olive mineralization is more associated with sulphides and quartz-sulphide veining in an interpreted shear-zone setting. An oxidation zone and a transition zone, from near total oxidation to only sulphides, have been defined. Veins can be only sulphides or sulphides with white quartz. Pyrite plus arsenopyrite (or arsenical pyrite) and quartz-pyrite veins are common, within the overall NE trending zone of mineralization.

History, Exploration and Drilling

Exploration drilling for intrusive-hosted gold mineralization began in the early 1990's and continued sporadically by several owners through 2004, including through StrataGold. Victoria Gold acquired StrataGold in 2009, and continued exploration drilling on the property. Since 2012, the majority of Victoria Gold's exploration work has been in-fill drilling at the Eagle Zone, and exploration efforts including trenching, geophysical surveys and drilling at the Olive Zone. In the winter of 2011-2012, Victoria Gold conducted a targeted in-fill drilling program consisting of core and Reverse Circulation (RC) drilling of an additional 130 drill holes in the Eagle Zone. The purpose of the targeted in-fill drilling program was to better define Measured and Indicated Mineral Resources. In 2017, an additional 2,557 metres of diamond drilling from four diamond drill holes was completed in the Eagle Zone.

The Olive Zone had been explored prior to Victoria Gold's ownership, with initial drilling in 1992, and sporadic follow-up drilling for a total of 19 holes by 2007. Victoria Gold conducted additional drilling of 58 holes in 2010-2012, in-fill drilling of 61 holes in 2014, and an additional 89 drill holes in 2016 in the Olive Zone.

The additional drilling allowed the Olive Zone to be defined as a Mineral Resource. Additional exploration work conducted at the Olive Zone included 17 shallow trenches in 2014 and 29 trenches in 2016, to expose and sample oxidized sulphide mineralization and help define the surface trace and extensions to mineralization. As well, a program of Internet protocol (IP)-Resistivity geophysical surveys was conducted over the core area of the Olive Zone in 2015. The results of the program concluded that there is a good correlation of IP chargeability highs with the modelled zone of anomalous gold mineralization in drilling, and a direct association of the gold with increased sulphide content.

A summary of exploration drilling and trenching, for which sample analyses have been used for Mineral Resource estimation can be found in the 2019 TR.

Metallurgical and Mineral Processing Test Results

Extensive metallurgical testing programs including column leach, bottle roll leach, gravity concentration and flotation tests were conducted on various composites from the Eagle deposit. Comminution, compacted permeability, cyanide neutralization and humidity cell studies were also performed. Additional testing including bottle roll leach and column leach tests were conducted on composites from the Olive deposit.

Leach data on the Eagle Zone composites, crushed with a high-pressure grinding roll and with conventional cone crushers, were compiled at several crush sizes. The results from the column leach test programs indicate that gold recovery is sensitive to crush size, ore type, and, to a lesser extent, crush type. Overall gold recoveries ranged from 68% to 79% at a P80 crush size of approximately 6.5 mm.

Leach data was also compiled on Olive oxide, transition and sulphide composites, crushed with conventional cone crushers to approximately 6.5 mm. Gold recoveries ranged from 54% to 68%.

The column leach test results show that crushing to a P80 size of approximately 6.5 mm with conventional crushers will lead to the projected recoveries for Eagle as projected by Forte Dynamics Inc. (Forte). Forte uses a first principle fraction-extraction equation by rock type to estimate total heap leach recovery from operations, specific to each rock type and their respective tonnages and grades, as a function of time. This provides a long-term ultimate recovery that can be expected.

The fraction-extraction method allows for a projection for the ROM recovery by modification of kinetics based on the projected particle size distribution for life of mine. ROM size distribution based on the first principles of diffusion and dissolution. The ROM particle size distribution for Eagle was estimated from a combination of data from current and other operations however not all lithologies have been encountered to date. Due to the limited data, the life of mine (LOM) recovery for Eagle ROM material is estimated at 60%. Lime and sodium cyanide requirements were similarly estimated to be 1.0 kg/t and 0.35 kg/t, respectively. The leach cycle to be utilized for ROM material will be 90 days.

Long term ultimate recoveries based on bottle roll and column testing were projected for each rock type. Field leach recoveries for Olive have been previously projected by Kappes, Cassiday and Associates (KCA) in 2016. Overall leach pad gold recoveries are dependent on the distribution of ore types and function of time. While these ultimate recoveries represent long term results, recovery as a function of time during active mining and leaching is estimated using the fraction-extraction values discussed in the 2019 TR.

Mineral Resource Estimates

This 2019 Technical Report includes an update to the Mineral Resource Estimate (MRE) for the Eagle Gold deposit, here called the Eagle Zone, as previously described in the JDS 2016 FS, and the MRE for the Olive Zone gold mineralization, a satellite deposit that is located approximately 2.5 km northeast of the Eagle Zone.

The MRE has been classified as “Measured”, "Indicated" and "Inferred" according to the CIM "CIM Standards on Mineral Resources and Reserves: Definitions and Guidelines" (May 2014).

A geological model was used for each deposit, consisting of lithology (granodiorite and metasediments), a mineralized shape defined from drill hole gold assays, and oxidation surfaces. Industry-standard statistical and geostatistical evaluations were performed, and data for both Eagle and Olive drill hole and trench assays were composited to 1.52 and 2.5 m, respectively. A block size of 10 x 10 x 5 m was used for each deposit with ordinary kriging for grade estimation from capped composited assays. Validation of the estimates was performed for both deposits. The estimation of the mineral resources was carried out with the Vulcan® software for the Eagle Zone and with the Datamine® software for the Olive Zone.

The current Eagle Zone Mineral Resources are reported as in-pit resources at a cut-off grade (COG) of 0.15 g/t Au.

The current Olive Zone in-pit Mineral Resources are reported at a cut-off grade of 0.40 g/t Au. The cut-off is supported by the same parameters as for Eagle, but with lower recoveries. The Olive cut-off grade was selected to provide higher-grade material for the project. Olive has a complete assay database for silver, whereas Eagle does not; thus, Olive has silver reported as an associated element.

Table 1: 2019 Pit Constrained Eagle Mineral Resource Estimate* (inclusive of Mineral Reserves)

| Classification | Quantity (M t) |

Gold Grade (g/t) |

Silver Grade (g/t) |

Contained Gold (koz) |

Contained Silver (koz) |

|---|---|---|---|---|---|

| Eagle (0.15 g/t Au cut-off) – Effective November 15, 2019 | |||||

| Measured | 37.4 | 0.71 | N/A | 850 | N/A |

| Indicated | 180.0 | 0.61 | N/A | 3547 | N/A |

| Combined | 217.4 | 0.63 | N/A | 4,397 | N/A |

| Inferred | 21.5 | 0.52 | N/A | 361 | N/A |

| Olive (0.40 g/t Au cut-off) | |||||

| Measured | 2.0 | 1.19 | 2.31 | 75 | 146 |

| Indicated | 7.5 | 1.05 | 2.06 | 254 | 498 |

| Combined | 9.5 | 1.08 | 2.11 | 329 | 645 |

| Inferred | 7.3 | 0.89 | 1.70 | 210 | 402 |

*Notes:

- CIM definitions were followed for Mineral Resources

- Mineral Resources are estimated at a cut-off of 0.15 g/t Au for Eagle and 0.40 g/t for Olive

- Gold price used for this estimate was US$1,700/oz

- High-grade caps were applied as per the text of this report

- Specific gravity was estimated for each block based on measurements taken from core specimens

- Resources are In-pit resources as defined by pit parameters described in the text of this report

- Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that all or any part of the mineral resources estimated will be converted into mineral reserves. The estimate of mineral resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues. However, there are no currently known issues that negatively impact the stated mineral resources.

- The inferred mineral resources have a lower level of confidence than that applying to measured and indicated mineral resources and must not be converted to mineral reserves. It is reasonably expected that the majority of inferred mineral resources could be upgraded to indicated mineral resources with continued exploration.

- The mineral resources do not account for mining depletion. Up to the effective date of the mineral resources, 2.44M tonnes at 0.82 g/t Au for 64,500 ounces of gold were mined.

- Source: Qualified Persons M. Jutras and F. Daviess

Mineral Reserve Estimate

The Mineral Reserve for the property is based on the Mineral Resource estimate for Eagle and Olive.

The Mineral Reserves were developed by examining each deposit to determine the optimal and practical mining method. COGs were then determined based on appropriate mine design criteria and the adopted mining method. A shovel and truck open pit mining method was selected for the two deposits.

The estimated Proven and Probable Mineral Reserves total 155M t at 0.65 g/t Au, containing 3,261k oz gold prior to mining activities. Reserve depletion up to November 15, 2019 totaled 2.44M t at 0.82 g/t and 64.5k oz.

| Area | Classification | Ore (Mt) |

Diluted Grade (g/t) |

Contained Gold (k oz) |

|---|---|---|---|---|

| Eagle | Proven | 30 | 0.71 | 694 |

| Probable | 118 | 0.63 | 2,366 | |

| Total | 148 | 0.64 | 3,061 | |

| Olive | Proven | 2 | 1.02 | 58 |

| Probable | 5 | 0.93 | 142 | |

| Total | 7 | 0.67 | 200 | |

| Eagle + Olive | Total | 155 | 0.65 | 3,261 |

Notes:

- A gold price of US$1,275/oz is assumed.

- Reserve based on original topo with no depletion from preproduction/ramp up period up to the effective date.

- A US$:C$ exchange rate of 0.75.

- Cut-off grades, dilution and recovery factors are applied as per open pit mining method.

Source: VGC (2019)

Table 3: Open Pit Mineral Reserves by Ore Type (Pre-Mining)

| Type | Area | Ore (Mt) |

Diluted Grade (g/t) |

Contained Gold (k oz) |

|---|---|---|---|---|

| Crushed Ore | Eagle | 114 | 0.77 | 2,818 |

| Olive | 7 | 0.95 | 200 | |

| Total | 121 | 0.78 | 3,018 | |

| Run of Mine Ore | Eagle | 35 | 0.22 | 243 |

| Olive | - | - | - | |

| Total | 35 | 0.22 | 243 | |

| Crushed + ROM | Total | 155 | 0.65 | 3,261 |

Notes:

- A gold price of US$1,275/oz is assumed.

- A US$:C$ exchange rate of 0.75.

- Cut-off grades, dilution and recovery factors are applied as per open pit mining method.

- Reserve based on original topo with no depletion from preproduction/ramp up period up to the effective date.

Source: VGC (2019)

The COGs for Eagle and Olive by ore type are listed in Table 4.

Table 4: Cut-off Grades by Deposit and Material Type

| Rock Type | Direct Crushed Feed - Break Even COG(g/t) | Direct Crush Feed -Incremental COG*(g/t) | Direct ROM Hauled to HLP - Incremental COG*(g/t) | Rehandled ROM Stockpile to HLP - Incremental COG*(g/t) |

|---|---|---|---|---|

| Eagle- Oxide Granodiorite | 0.25 | 0.15 | 0.15 | 0.20 |

| Eagle- Altered Granodiorite | 0.29 | 0.17 | 0.15 | 0.20 |

| Eagle-Unaltered Granodiorite | 0.30 | 0.17 | 0.15 | 0.20 |

| Eagle-Oxide Metasediments | 0.30 | 0.17 | 0.15 | 0.20 |

| Eagle-Unaltered Metasediments | 0.32 | 0.19 | 0.15 | 0.20 |

| Olive - Oxide | 0.46 | 0.20 | not defined | not defined |

| Olive - Mixed | 0.56 | 0.24 | not defined | not defined |

| Olive - Sulphide | 0.58 | 0.25 | not defined | not defined |

Notes:

- Direct Crush Feed Incremental COG: Bottom Incremental cut off grade for material that are fed directly from the pit to the Primary Crusher that covers leaching and crushing costs only.

- Direct ROM Hauled to HLP Incremental COG: Bottom Incremental cut off grade for material that are placed directly from the pit to the heap leach facility that covers leaching costs and extra incremental haulage only.

- Rehandled ROM Stockpile Incremental COG: Bottom incremental cut off grade for material that are placed directly from the pit to the ROM stockpile that covers leaching, ROM re-handling and extra incremental haulage costs only. Incremental material is only fed when production targets are met, and spare plant capacity is available.

- Source: VGC (2019)

The mineral reserve estimations take into consideration on-site operating costs (mining, processing, site services, freight, general and administration), geotechnical analysis for open pit wall angles, metallurgical recoveries, and selling costs. In addition, the Mineral Reserves incorporate allowances for mining recovery and dilution and overall economic viability.

Mining

The Eagle and Olive deposits are being mined using open pit methods, and operate as drill, blast, shovel and haul operation with a combined nominal rate of 29,500 t/d ore and 7,500 t/d ROM ore and a remaining mine life of 11.5 years. Open pit mining operations are comprised of a fleet of 22 m3 front shovels, 12 m3 front-end loaders and 136 t haul trucks. This fleet is supported by drills, graders, and track and dozers. Benches are mined at a height of 10 m in both ore and waste with an overall 20 m effective bench height based on a double-bench final wall configuration.

Mining commenced in Q2 of 2019 in the Eagle pit to provide waste rock for construction and allow for access roads to be built. Leachate processing also commenced in Q3 of 2019 and is currently ramping up to full production in 2020. Open pit mining will focus on the various Eagle pit phases with the smaller Olive pit coming into production in 2028. Open pit mining and loading of the heap leach facilities will be completed in Q2 of 2031.

Starting from the beginning of 2020, the mine is expected to produce a total of 149.0M t of heap leach feed and 144.9M t of waste (at a 0.97:1 overall strip ratio). Ore to be crushed will be hauled to the primary crusher located towards the north-east side of the Eagle pit. ROM ore will be hauled directly to the primary HLP. ROM material will only come from the Eagle pit.

The current LOM plan focuses on achieving consistent heap leach production rates, mining of higher value material early in the production schedule, as well as balancing grade and strip ratios. Given that the secondary and tertiary crushers and HLP will only be operated between April and December of each year, stockpiles will be used when necessary for stockpiling of ore from the open pit. The handling of the ore from the crusher to the HLPs is included in the open pit scheduling and operating cost estimation. The detailed life-of-mine material movement by year for both the mine and the heap leach facilities can be found in the 2019 TR.

Recovery Methods

Two heap leach pads will be used to extract gold from ore into solution; the primary HLP, which has been constructed, and the secondary HLP, which will be developed. The secondary HLP will be developed in time to receive ore in approximately Year 8 of operations. The current plan is to stack both crushed and ROM ore on the primary HLP.

Crushed ore is fed through a three-stage crushing plant to produce an 80% passing (P80) 6.5 mm product. ROM ore will bypass the crushing plant. Gold is leached with cyanide solution and recovered through the ADR (Gold Recovery) plant.

The process plant is located near the primary HLP to minimize pumping and pipeline requirements for both pregnant and barren solutions during the first seven years of operation.

The HLPs will undergo year-round leaching with the stacking of ore occurring 275 days per annum (d/a).

Ore Crushing, Handling and Stockpiling

Crushed Ore

Ore above 0.30 g/t from the Eagle pit is sent to a three-stage crushing plant. The crushing circuit consists of one 375 kW primary gyratory crusher, one 932 kW secondary cone crusher and three, parallel 932 kW tertiary cone crushers. Crushing plant feed material, with a maximum top size of 1,000 mm, is trucked from the open pits and dumped directly into the primary gyratory crusher at a throughput of approximately 29,500 t/d. The primary crusher will operate 365 d/a, while the secondary and tertiary crushers will only operate 275 d/a when ore is stacked on the HLPs.

From Q2 through Q4 of each year, stockpiled crushed ore will be reclaimed via a loader / hopper / conveyor system to the secondary crusher. Crushed ore reclaiming will be done at 470 tonnes per hour (t/h), and combined with the primary crusher discharge, at a total rate of 39,200 t/d, to the secondary and tertiary crushing circuits. The tertiary product, screen undersize at P80 of 6.5 mm, will feed a series of conveyors and grasshopper conveyors to a radial stacker on the HLP. Lime will be added to the tertiary screen discharge conveyor for pH control.

ROM Ore

ROM ore (less than 0.30 g/t but above the cut-off grade of 0.15 g/t) will be sent directly from the Eagle pit to the primary HLP during the stacking months, and to the ore stockpile during the stockpiling months (January to March). The ROM ore will be reclaimed from the stockpile using a loader and trucks and taken to the primary HLP. The ROM ore will be segregated from the crushed ore but will be placed within the overall primary HLP.

Stockpiling

An ore stockpile area with a capacity of approximately 3M t will be established to allow the stockpiling of ore on a temporary basis during the coldest winter months (Q1 of each year). Crushed ore stockpiled during the winter months is placed in a stockpile after passing through the primary crusher only. ROM ore is stacked in a stockpile during Q1.

Heap Leach Pad

The constructed primary HLP will accommodate up to 90M t of ore and is located approximately 1.2 km north of the Eagle Zone orebody, in the Ann Gulch valley. The base of the primary HLP is located at an elevation of 880 metres above sea level (masl), and at full height, the primary HLP will extend up Ann Gulch to an elevation of approximately 1,225 masl at the top of the planned ore stack.

The proposed secondary HLP will commence in approximately Year 8 and will accommodate the remaining ore (with expansion potential) and is planned to be located approximately 3 km east of the Eagle Zone orebody near the Olive Zone pit. The base of the secondary HLP is planned to be located in the upper portion of the basin at an elevation of 1,300 masl, and at full height, the secondary HLP will extend to an elevation of approximately 1,470 masl at the top of the planned ore stack.

The primary HLP is comprised of a number of elements: a confining embankment to provide stability to the base of the HLP and a sump for operational in-situ storage of process solution, a lined storage area for the ore to be leached, pumping wells for the extraction of solution, a lined events pond to contain excess solution in extreme events, upstream surface water interceptor ditches, and leak detection, recovery and monitoring systems to ensure the containment of solution. The secondary HLP design is proposed to mimic the primary HLP.

The primary HLP is irrigated with a barren cyanide-caustic solution fed from the process plant through pipelines and drip emitters incorporated in the HLP. The barren solution percolates through the HLP and dissolves gold producing a gold-bearing “pregnant” solution. The pregnant solution is pumped from the HLP at a current nominal rate of approximately 1,000 m3/h to the carbon adsorption circuit and will eventually ramp up to a nominal rate of 2,070 m3/h following 1.5-2 years of ore loading and stacking. The flowrate of barren solution is based on a 45-day primary leach cycle and a secondary leach cycle of additional 45-days assuming an application rate of 7-10 l/h/m2 and a lift height of 10 m.

Processing Plant

The pregnant solution enters the Gold Recovery Plant through the carbon adsorption circuit, which consists of two trains of five cascading-flow carbon columns. The barren solution discharged from the final carbon column is pumped to the barren solution tank. Liquid sodium cyanide solution, caustic, and antiscalant are added to the barren solution to maintain the required pH and cyanide concentrations for leaching.

Loaded carbon is extracted from the first carbon adsorption columns at a rate of 8 t/d (4 t/d per train) and is acid washed prior to advancing to the desorption circuit for gold recovery in the strip vessel. The available area under leach and pregnant solution flow currently only supports operation of a single train of carbon columns, and therefore, carbon is extracted from the first two columns in the train to provide eight tons of total carbon to the acid wash and strip vessels. As solution flow ramps up following 1.5-2 years of ore loading, the other train will be utilized for gold recovery.

The pregnant solution from the strip vessel flows to the electrowinning circuit. At the conclusion of the strip cycle, the stripped carbon is thermally regenerated in the carbon reactivation kiln and then returned to the carbon columns.

Gold sludge is plated onto steel wool cathodes in the electrowinning cells. The gold-bearing sludge is dried, fluxed, and then smelted to produce gold doré.

A gold production model was developed to predict the gold production from the HLP operation and is based on a combination of metallurgical testing data, the mine production schedule, the HLP construction sequence (or stacking plan), and the leaching (irrigation) plan for the application of barren solution.

The gold production model uses discretized cells loaded through time based on the ore loading schedule. For each cell, grade by lithology is tracked along with planned leaching operations to determine the gold recovered over time.

Utilizing the leaching operations for the Eagle Project, the recovery per cell was calculated over time utilizing previous metallurgical testing work. The gold recovery was calculated for each rock type, within each cell through time, to produce recovery based on the dissolution and diffusion of the gold coupled with leaching operations. At the end of the HLP life, the gold recovered from the HLPs is approximately 77%.

During the winter, when ore stacking onto the HLPs is stopped, the barren solution will still be applied to the HLP, and gold recovery from ore will continue.

During initial leaching of the primary and secondary HLPs, there will be an in-process inventory of recoverable gold built up. The inventory of recoverable gold will be from the recoverable gold in the ore in the heaps that has not been leached to completion, and is contained in solution inventories, carbon, and in the electrowinning / refining circuit that has not yet been processed into doré. Gold inventory in solution, carbon and the electrowinning / refining circuit will ultimately be recovered through residual leaching operations.

Solution will continue to be added in Year 8 for the primary and in Year 12 for the secondary HLP, to allow the last ore stacked to be leached to completion. Residual leaching may continue beyond these estimated time frames depending on project economics, relating to continued residual gold recovery and operating costs.

Infrastructure

The Eagle Gold Mine development included the construction of various ancillary facilities and related infrastructure, for which locations were selected to take advantage of local topography, to accommodate environmental considerations, and reduce capital and operating costs.

Mine facilities and infrastructure include: a primary heap leach pad, comprised of a sump, a lined storage area, an in-heap storage area, pumping wells, events ponds, diversion ditches, leak detection, recovery and monitoring systems; fresh water supply systems to treat and distribute process, fire, and potable water; access and site roads; water treatment infrastructure, including potable and sewage treatment infrastructure; power supply and distribution, including: a 43.5 km long, 69 kV power supply line from the Yukon Energy Corporation’s power grid McQuesten switching station, approximately 25 km southeast of the property; 13.8 kV power distribution from the mine site substation to all the facilities; and Process control and instrumentation communication systems. Ancillary facilities include: warehouse, cold storage and laydown areas; administration buildings; on-site fuel storage for diesel, gasoline & propane; on-site explosive storage and magazines; assay laboratory; and permanent camp accommodations complete with recreation area, commissary, first aid and laundry facilities.

Future mine facilities and infrastructure will include: a secondary heap leach pad, comprised of a sump, a lined storage area, an in-heap storage area, pumping wells, events ponds, diversion ditches, leak detection, recovery and monitoring systems; water treatment infrastructure, including a Mine Water Treatment Plant (MWTP) with cyanide detoxification capacity; and ancillary facilities, including a truck shop.

A current site layout is provided in Figure 2.

Figure 2: Eagle Mine Site Layout

Environment and Permitting

The Eagle Gold Mine has been assessed under the Yukon Environmental and Socio-economic Assessment Act (YESAA) and currently holds a Quartz Mining License (QML) and a Water Use License (WUL) to construct, operate and close the Project.

As discussed in Section 1.5, the project area has an extensive exploration history involving a number of prior operators, some of whom had undertaken the collection of baseline environmental, socio-economic, land use, and heritage data. In 2007, StrataGold re-initiated the collection of environmental baseline data, which includes the disciplines of climate, water quality, hydrology, hydrogeology, aquatic biota, wildlife, air quality and vegetation. Fieldwork to characterize climatic, hydrological, hydrogeological, air, vegetation and water quality conditions is ongoing.

Victoria Gold and prior operators have also characterized local and regional land use and socio-economic conditions, First Nations land use and activities, and archaeological and heritage resources.

Prior to construction or operational activities taking place, mining projects in the Yukon are required to undergo an assessment of potential project effects pursuant to the YESAA. The YESAA process mandates that an applicant describe the scope of the project, the existing environmental and socio-economic setting, potential environmental and socio-economic effects of the project, and the measures that will be instituted by the applicant to mitigate those effects. The applicant also has a statutory obligation to consult any First Nation or resident of any community residing in the territory in which the project will be located or might have significant environmental or socio-economic effects on.

This duty to consult the parties must be completed to the satisfaction of the Yukon Environmental and Socio-economic Assessment Board (YESAB), based upon their consideration of any submitted material and discussions with the parties, before the formal review of a project may commence. The YESAA review process results in a recommendation by the YESAB to federal, territorial or First Nation governments or agencies that will regulate or permit the proposed activity for measures to reduce, control or eliminate project effects. These governments or agencies, referred to as Decision Bodies, will then decide whether to accept, reject, or vary the YESAB’s recommendation in a final Decision Document. Upon receipt of positive final Decision Documents by the Decision Bodies, a project may then proceed to the licensing phase.

Mining projects in the Yukon require permits and approvals issued pursuant to various federal and territorial legislation. The major regulatory approvals that must be received for a mining project during the licensing phase are generally a QML, under Section 135 of the Yukon’s Quartz Mining Act, and a WUL, under Sections 6 (1) and 7 (1) of the Waters Act (Yukon).

The Eagle Gold Project has successfully completed the YESAA environmental assessment resulting in a positive final Decision Document in 2013. Victoria Gold subsequently applied for and received a QML and a Type A WUL for the construction, operation and closure of the Project. Pursuant to the QML and WUL, Victoria Gold was able to begin the construction of the above facilities and undertake the associated activities immediately upon posting a bond, providing issued for construction drawings, and satisfying other minor requirements.

Project components not currently included in the QML or WUL include the Olive pit, expansion of one of the WRSAs into an adjacent watershed, the secondary HLP and the related project infrastructure required for developing these facilities. The project components not currently included in the QML or WUL will need to undergo a review pursuant to the YESAA and require the subsequent amendment to each license. Victoria Gold has estimated permitting of these additional elements can be completed within three years.

The Olive pit, development of a third WRSA, expansion of one of currently permitted WRSAs into an adjacent watershed, the secondary HLP and the related project infrastructure required for developing these facilities are not considered in the mine plan until 2023. This provides sufficient time to complete the assessment of the facilities pursuant to the YESAA and receive the required regulatory amendments in advance of intended development and does not present a significant risk of interruption to operations.

First Nations’ Considerations

The project is located entirely within the Traditional Territory of the First Nation of Na-Cho Nyäk Dun (FNNND). The statutory requirement to consult on the project and to satisfy previous, and any future, assessments of the project under the YESAA involves the FNNND. To ensure that the FNNND, and the community of Mayo, have an opportunity for input at all key stages of project development, Victoria Gold has made it a priority to conduct early and ongoing consultation with the FNNND, and the community of Mayo, to ensure opportunities for input from both parties at all key stages of project development.

On October 17, 2011, Victoria Gold and the FNNND signed a comprehensive Cooperation and Benefits Agreement (CBA). The CBA replaced an earlier Exploration Cooperation Agreement and applies to the Eagle Gold mine development and exploration activities conducted by Victoria Gold anywhere in the FNNND Traditional Territory south of the Wernecke Mountains.

The objectives of the CBA are to:

- Promote effective and efficient communication between Victoria Gold and the FNNND in order to foster the development of a cooperative and respectful relationship and FNNND support of Victoria Gold’s exploration activities on the project;

- Provide business and employment opportunities, related to the project, to the FNNND and its citizens and businesses in order to promote their economic self-reliance;

- Establish a role for the FNNND in the environmental monitoring of the project and the promotion of environmental stewardship;

- Set out financial provisions to enable the FNNND to participate in the opportunities and benefits related to the project; and

- Establish a forum for Victoria Gold and the FNNND to discuss matters related to the project and resolve issues related to the implementation of the CBA.

Capital Cost Estimates

The initial capital used to construct the Eagle Gold Mine was spent between August 2017 and July 2019. Capital expenditures for the Mine included:

- Earthworks for process facilities, infrastructure, roads, HLF embankment and events pond, and water management structures;

- Pre-production mining;

- Process facilities including:

- Primary crusher building and coarse ore storage;

- Secondary / Tertiary crusher building;

- Conveyor systems;

- Gold Recover plant; and

- Heap Leach facility.

- Warehouse and laydown areas;

- McQuesten Switching Station and 69kV power line to the mine site;

- On-site 4.95mW power generation facility; and

- Camp and supporting infrastructure.

The initial capital phase of the project was completed in Q3 2019 ahead of schedule. Total pre-production capital cost of the Project phase was reported as $487.2 M.

An additional $209.5 M will be required as sustaining capital over the LOM including: expansion of the HLF liner and pipework system; construction of a truck shop; construction of a Water Treatment Facility; and value-added infrastructure development projects identified to improve the operation as a whole. This amount includes an allowance of $35.0 M for closure (net of salvage value).

Operating Cost Estimates

Operating costs include all normal, recurring costs of production including:

- Open pit mining (labour, maintenance, fuel, explosives, technical services);

- Processing (process consumables, maintenance);

- Site & Associated Corporate Support;

Operating budgets are based on first principle calculations provided by each respective department as well as historical cost trending. Budgets are updated in detail annually to reflect changes in markets, consumable prices and site-specific operating parameters.

The Eagle Gold Mine operating costs consist of both variable and fixed cost items. Variable costs have a linear correlation to cost drivers such as open pit production, equipment hours or process throughput, while fixed costs do not.

Table 5 depicts modeled estimates of the associated operating costs for 2020 and the remainder of Eagle Mine’s production schedule in Canadian dollars and in real terms.

Table 5: Operating Cost Summary

| Category | LOM(M $) | $/t leached |

|---|---|---|

| Mining | 721.3 | 4.84 |

| Processing | 724.0 | 4.86 |

| G&A | 406.9 | 2.73 |

| TOTAL | 1,852.2 | 12.43 |

Source: VGC (2019)

Economic Analysis

An economic model was developed to reflect projected annual cash flows and sensitivities of the project. All costs, metal prices and economic results are reported in Canadian dollars (C$ or $) unless stated otherwise.

Results

The parameters used in the economic model and the results are shown in Table Error! No text of specified style in document. 6. The LOM economic model does not calculate a meaningful Internal Rate of Return (IRR) as there are no upfront annual net cash outflows. This economic model excludes any servicing of the debt incurred to finance the Project.

All costs and revenues are assumed to be paid and received in the period that they are incurred and produced. There is no working capital in the model.

Table 6: Economic Results

| Parameter | Unit | Value |

|---|---|---|

| Au Price | US$/oz | 1,300 |

| Exchange Rate | US$:C$ | 0.75 |

| After-Tax Free Cash Flow | M$ | 1,351.8 |

| Avg M$/yr* | 123 | |

| Pre-Tax NPV5% | M$ | 1,388.6 |

| After-Tax NPV5% | M$ | 1,034.2 |

*Includes full production years only

Source: VGC (2019)

Opportunities

As the Project continues to develop, Eagle Gold Mine will strive for continuous improvement of operations through the following initiatives:

- Year‐round stacking;

- Continued near-mine exploration with a focus on the Potato Hills Trend, which hosts the Olive, Shamrock and other targets;

- Reduction of operating costs;

- Reduction or elimination of re-handling of ore on the leach pad;

- Further refinement of water management and water treatment; and

- Improvement upon production targets.